Brian Duffy

The Independent Non-Executive Director of Celtic PLC is described on the Celtic website, http://www.celticfc.net/corporate_boardofdirectors :

In The Scotsman on 30th January 2012, Duffy was lauded as a success: ‘Being in the right place at the right time. That’s what Professor Brian Duffy, president and chief operating officer of Polo Ralph Lauren Europe and a non-executive director of Celtic FC, says is the key to his success, the explanation as to how a working-class boy from Castlemilk ended up at the pinnacle of a global luxury brand.’

‘The life of Brian has followed an upward trajectory, with Castlemilk and Balornock being the crucible that set Duffy on his globetrotting path. An ambitious child, he trained as a chartered accountant with KPMG after leaving school in the 1970s. “I wanted to be a success. I was always confident and loved the thought of chartered accountancy because it seemed established and was a means by which you could travel,” says the 57-year-old.’

What does a President/Chief Operating Officer of Ralph Lauren Europe do? Well Ralph Lauren’s European headquarters are in Switzerland, a Tax Haven. Mr Duffy, as well as no doubt running merchandising & supply chain operations, helped operate their Tax Avoidance operations in Switzerland which is the main purpose of locating there. As a Chartered Accountant, prior to becoming President and Chief Operating Officer of Ralph Lauren Europe in 2003, he cannot deny he didn’t understand Ralph Lauren Europe’s ‘tax-efficient’ structures. Just last year, March 2012, he retired so that was 9 years of ‘tax-efficiency’.

How does Ralph Lauren Europe’s Tax Avoidance work?

Look at Ralph Lauren’s UK website: http://www.ralphlauren.co.uk

At the bottom of the screen, click ‘Terms of Use’ then on the LHS column click ‘Terms of Sale’. Scrolling down you find that although it is a UK website, the items for sale are made by a Swiss company:

So UK sales, through the website, are designated sales by a Swiss company to avoid Ralph Lauren paying UK Corporations Tax. For multinationals like Ralph Lauren, Switzerland has lower or zero taxes compared to the UK which prevent UK domestic retail companies to compete on a level playing field.

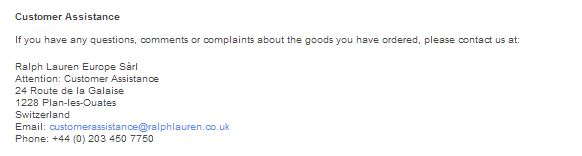

Further down, under Customer Assistance, the email has a UK domain [.co.uk] and UK phone number:

Welcome to the world of Tax Avoidance where, in parallel worlds, you are purchasing in the UK but the transaction is occurring in Switzerland, a Tax Haven. Or as Nicholas Shaxson called his first chapter in his book: Welcome to Nowhere.

The same Ralph Lauren parallel world of ‘Terms of Sale’ apply to their websites operated in the domains of France, Monaco, Belgium, the Netherlands, Luxembourg, Italy, Greece, Spain and Portugal.

Ralph Lauren copied Amazon’s tax-efficient structure

The Independent UK describes how Amazon’s UK website sales go through Amazon EU Sàrl in Luxembourg and avoids UK tax:

‘In the UK, it officially designates its seven warehouses in England, Scotland and Wales as “order fulfilment” — essentially delivery businesses – while sales are registered to a separate company, Amazon EU Sàrl in the low-tax principality of Luxembourg.

For last year, 2011, according to an investigation by the Bookseller magazine, Amazon generated sales of more than £3bn, but paid no UK corporation tax on that turnover.

Accounts filed by Amazon EU Sàrl show that in 2010, the Luxembourg office had sales of £6.5bn and employed 134 people, while its UK operation employed 16 times more people, 2,265, but had sales more than 40 times lower, £147m.

Over the past three years alone Amazon’s UK sales were between £7.6bn and £10.3bn, but for a longer period, 2003 to 2011, its UK registered company paid £3m tax.’

More Than a Club

Celtic make a big thing of their culture being based on their founder Brother Walfrid‘s ethos of looking after the poor. However the only way that can happen is by paying tax. Only by paying tax can the public coffers be replenished to pay for Hospitals, Schools, Roads, free Education, Social Security and the security provided by the Police & Armed Forces. And allow local government entities like Glasgow City Council to fund freebies given for the re-development around Parkhead, including cheap land transfers & destruction of heritage listed buildings, all under the guise of preparation for the Commonwealth Games. Independent Director, Brian Duffy, joins film partnership tax avoiders Chief Executive, Peter Lawwell, and Finance Director, Eric Riley, who are also Accountants [the handmaidens of tax avoidance] , and Manager Neil Lennon in the Tax Avoidance stocks. Mr Duffy no doubt provides the benefit of all his experience on Celtic’s Audit and Remuneration Committees. He worked for Playtex so should be able to give them lots of support.

©footballtaxhavens.wordpress.com

Discussion

No comments yet.