In researching how HMRC is starting to handle footballer Image Rights I came across this oral testimony from an HMRC employee at the UK Parliament’s Public Accounts Committee hearing into High Net Worth Individuals & HMRC held on the 7th December 2016. The comments are firstly by Jon Thompson, Chief Executive and Permanent Secretary, HMRC and then by Jennie Granger, Director General, Enforcement and Compliance, HMRC:

The earlier 3 paragraphs concern player Image Rights but in the last paragraph Ms Granger says that the HMRC has been working with football associations, presumably in Scotland that would be the SFA and SPFL, concerning the marketed avoidance schemes i.e film partnerships (LLPs – Limited Liability Partnerships). These LLPs, through which high net worth people, largely footballers invested to obain tax deductions have been declared tax avoidance schemes. In some cases this has led to several footballers declaring themselves bankrupt.

The co-ordination between Scottish football authorities and HMRC has not been publicised by any of the parties. Nothing has been mentioned in the media. I wonder why? Could it be that Celtic ex-players & management and directors currently and in the past do not want this to see the light of day?

The propensity to conceal from the HMRC, SFA & SPFL, Celtic and football media is totally different from the witch hunt that continues with the Employee Benefits Trust (EBTs) legal schemes used by Rangers.

There is no doubt about the legality of the EBT schemes. Here’s Jim Harra HMRC’s comment to then Stirling MP Anne McGuire, again at a Public Account Committee meeting, this time on the HM Revenue & Customs Annual Report 2013-14 on Wednesday 16 July 2014 regarding EBTs:

Q53 Mrs McGuire: Can I ask what the current legal status is of employee benefit trusts? Can I turn to a piece of documentation or a link that will give me secure information? Can I be confident that an EBT is in compliance with HMRC rules? Or are they all up for grabs?

Jim Harra: Employee benefit trusts are entirely legal. There can be good non-tax reasons why an employer would wish to set one up, but we did see a significant drive a few years ago. One of the key reasons for setting them up was to avoid pay-as-you-earn and national insurance obligations. We have published information about what is and is not acceptable from a tax point of view, and what we will challenge from a tax point of view, as well as the settlement opportunity that is available to companies if they choose to avail themselves of it.

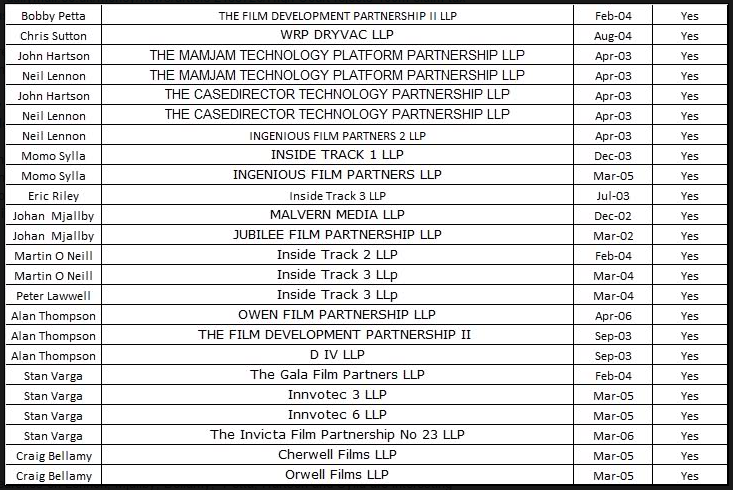

Celtic’s LLP Tax Avoidance Hall of Fame

Years ago, a Rangers blogger called Bill Poole kindly collated all the Celtic footballers, management and directors who used partnership tax avoidance vehicles, many related to film funding.

Here is the table of personnel and their LLPs:

Many of the above details from Companies House records are available in the Daily Record article by Graeme Thomson on 12 October 2016:

SFA/SPFL Board members involvement in the Tax Avoidance Schemes

As well as many Celtic ex-players and ex-management including Martin O’Neil, Neil Lennon, Johan Mjalby, Alan Thompson and TV pundits like John Hartson and Chris Sutton (who declared himself bankrupt through the effect of tax avoidance schemes) who have spouted extensively about EBTs and Sporting Integrity there are also current and former Celtic directors.

Peter Lawwell is the current CEO and director at Celtic PLC as well as being on the SFA Board.

Eric Riley was Celtic’s Finance Director and their representative on the SPL/SPFL board but has recently retired due to ill health.

Absolutely incredible that persons with financial/accounting backgrounds at the level of directors of a major football team and members of the boards of both major football authorities.

Surely Stewart Regan, Chief Executive of the SFA and Neil Doncaster, Chief Executive of the SPFL would not leave themselves open to accusations of cover-up of the film partnership tax avoidance problem causing bankruptcy to ex-footballers largely centred around Celtic FC while they poured petrol on the witch hunt surrounding Rangers use of EBTs?

Do SFA minutes exist to prove there was no conflicts of interest by Mr Lawwell being involved in HMRC as a SFA board member and guiding this lack of transparent examination of the affects of these tax avoidance LLPs on exposed footballers financial futures when his club appears to be ground zero in the promotion of these LLPs?

Did any details arise that Celtic promoted these tax avoidance schemes to players to attract players and give access to promoters to their players? The number of players involved and at all levels of the hierarchy including the very top of the tree at one club seems to imply it is more than coincidental.

HMRC also again leaves itself open to accusations that they hounded a financially wounded Rangers although they knew Craig Whyte’s history before he ‘bought’ Rangers and said nothing. (When is Keith Jackson going to print the HMRC letter’s when they were chasing Craig Whyte which went quiet while they allowed him to destroy Rangers?) HMRC wanted Rangers head as a deterrent to others and to establish precedent. That I understand. However HMRC seems to like doing private deals with some parties and public executions for others. They do not even try to act in an equitable manner. So is the SFA/SPFL doing deals on Celtic’s behalf with the HMRC to rescue their tax avoiders?

Public Witch Hunt for Rangers. Quiet Sweep Under the Big Carpet for Celtic yet again?

A peculiar version of Sporting Integrity has existed in Scottish footballing authorities for many years so the above being hidden is no surprise.

©footballtaxhavens.wordpress.com 2017

Discussion

No comments yet.